Validation of a Model for Developing Foresight Skills among Managers of Sepah Bank

Keywords:

Foresight, managerial skills, organizational development, banking, confirmatory factor analysis, structural modelingAbstract

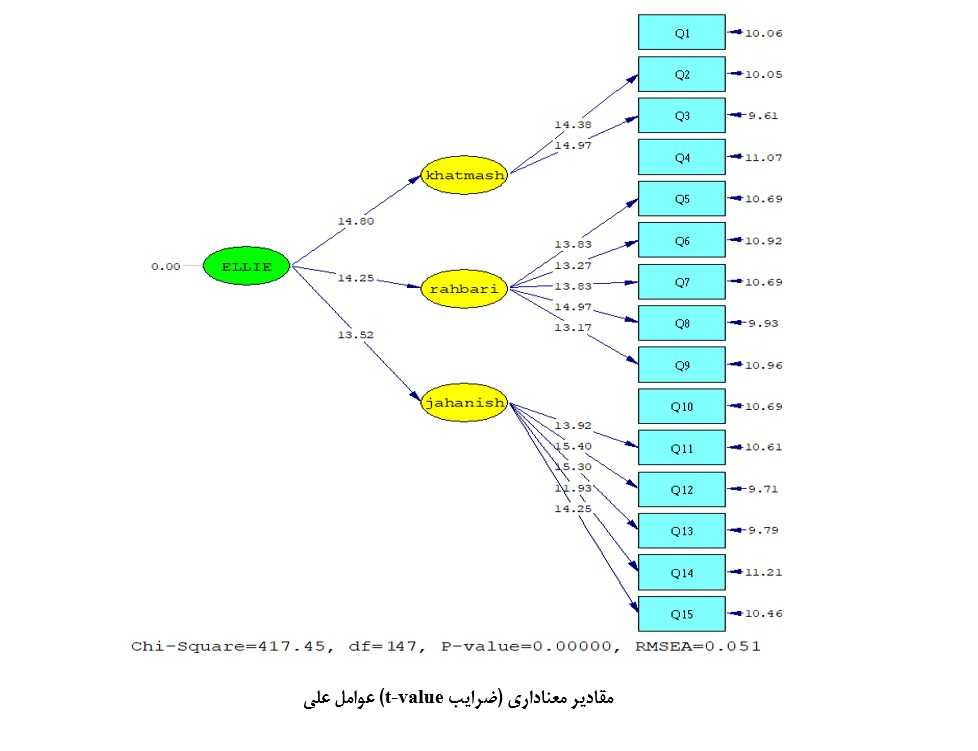

The objective of this study was to design and validate a model for developing foresight skills among managers of Sepah Bank in Alborz Province. This applied research employed a cross-sectional survey design. The statistical population consisted of 985 managers and employees of Sepah Bank, from which 278 participants were selected using the Krejcie and Morgan table; ultimately, 289 valid questionnaires were collected. Data were gathered using a researcher-made questionnaire comprising 112 items, 21 components, and 6 main factors, whose validity was confirmed by banking and academic experts and whose reliability was approved using Cronbach’s alpha. Data were analyzed using confirmatory factor analysis (CFA) with SPSS and LISREL software. Model fit was assessed through indices such as chi-square/df ratio, RMSEA, GFI, and AGFI. CFA results indicated that all model paths were statistically significant at the 0.05 level, with all t-values exceeding ±1.96. The highest factor loading was observed for organizational culture and behavior (0.97), followed by communication skills and flexible organizational structure. All causal, contextual, intervening, strategic, and outcome factors demonstrated significant and strong relationships with the main latent construct. Model fit indices showed acceptable and strong fit (χ²/df<3, RMSEA<0.08, GFI and AGFI>0.90). Strategic factors such as continuous learning, research skills, and effective communication exhibited the strongest effects, while outcomes such as strategic planning, value creation, competitive advantage, and decision-making agility were directly influenced by foresight skill development. The findings indicate that developing foresight skills among banking managers is a multidimensional process shaped by organizational, environmental, and technological factors, and it enhances organizational agility, competitive value creation, and strategic decision-making within the banking sector.

Downloads

References

Khazaei M. Futures Studies and Strategic Planning in Dynamic Organizations2011.

Hines A. Foresight and futures studies: A strategic compass in times of uncertainty. Journal of Futures Studies. 2020.

Slaughter R, Hines A. The Knowledge Base of Futures Studies 2020: Association of Professional Futurists; 2020.

Rohrbeck R, Kum ME. Corporate foresight and its impact on firm performance: A longitudinal analysis. Technological Forecasting and Social Change. 2021;168:120737.

Mohammadi A, Kazemi F. The Effect of Futures Studies Training on Strategic Decision-Making of Bank Managers. Islamic Banking and Financial Studies Quarterly. 2022;12(1):93-110.

Zhang M, Wang Y, Wang W. Big data analytics managerial skills and organizational agility: A moderated mediation model. Industrial Management Data Systems. 2025;125(1):168-91. doi: 10.1108/IMDS-01-2024-0053.

Tsirkas K, Dimitriadis E, Lassia I. The gap in soft skills perceptions: A dyadic analysis. Education and Training. 2020. doi: 10.1108/ET-03-2019-0060.

Salman A, Singh R, Kumar R. Soft skills and foresight as predictors of organizational performance in Indian banks. International Journal of Bank Marketing. 2020;38(6):1220-38.

Dixit S, Sharma V, Patel R. Future skills integration and digital transformation in BFSI sector: A systematic review. Journal of Banking Innovation Research. 2024;9(2):67-89.

Dixit S, Sharma V, Patel R. Unlocking employee potential in BFSI: A thematic synthesis on soft skills development and its challenges. ACR Journal. 2024.

Ghaffari A, Ahmadi M, Taghavi S. Identifying Futures Studies Components in the Training System for Managers of Government Organizations. Human Resource Development Management Quarterly. 2021;7(2):25-46.

Gholizadeh Zavoshti M, et al. Identifying Key Capabilities of Strategic Foresight in Iranian Banks and Financial Institutions. Government Management Scientific-Research Quarterly. 2019;11(4):55-73.

Mobarakabadi H. The Role of Training Futures Studies Skills in Empowering Organizational Managers. Management Futures Quarterly. 2014;5(2):45-62.

Fallah R, Karimi S. Designing a Strategic Competencies Model for Managers in Iran's Banking Industry. Management and Organizational Transformation Quarterly. 2023;15(2):33-52.

López-Fernández M, Romero-Fernández PM. Competencies and Managerial Skills. International Managerial Skills in Higher Education Institutions: IGI Global Scientific Publishing; 2025. p. 1-16.

Lukash V. The impact of managers' strategic thinking and skills on business process management development: Vilniaus Universitetas; 2025.

Kavand N, Mohammadi Moghadam Y. Analyzing the De-Skilling of Managers in Skill Enhancement in the Era of Digital Transformation. Studies in Smart Business Management. 2025;13(52):47-86.

Ahmed F, Arora P, Khan S. Impact of employees' engagement and knowledge sharing on organisational performance: Study of HR challenges in the COVID 19 pandemic. Human Systems Management. 2020. doi: 10.3233/HSM-201052.

Arefjevs I, Reihmane I, Josifovs J. Financial sector evolution and competencies development in the context of information and communication technologies. Research for Rural Development. 2020. doi: 10.22616/rrd.26.2020.038.

Vecchiato R. Scenario planning, strategic foresight, and emerging technologies: An analysis of the organizational benefits. Futures. 2020;117:102514.

Giorgi G, Lecca L, Perez F. Work related stress in the banking sector and its association with recovery experiences. International Journal of Occupational Medicine and Environmental Health. 2021.

Giorgi G, Lecca L, Perez F. Learning foresight and resilience among European bank employees. European Journal of Management Studies. 2021;26(4):411-27.

Kowalski THP, Loretto W. Well being and HRM in the changing workplace. International Journal of Human Resource Management. 2021.

Nguyen Q, Phan TH, Le NM. Talent conceptualisation and talent management approaches in the Vietnamese banking sector. Journal of Asian Finance, Economics and Business. 2020;7(7):195-204. doi: 10.13106/jafeb.2020.vol7.no7.453.

Downloads

Published

Submitted

Revised

Accepted

Issue

Section

License

Copyright (c) 2025 Azadeh Ali Barouti Tabar, Naser Abbaszadeh, Hamid Shafizadeh (Author)

This work is licensed under a Creative Commons Attribution-NonCommercial 4.0 International License.